Investor Trip to SE Asia

/We had a productive and informative investor trip to SE Asia this past month. Our group of 17 traveled to Singapore, Vietnam, and Thailand, with an extension trip to Angkor Wat in Cambodia. During the trip, we met with all three SE Asius managers and eight of their portfolio companies.

Group meeting with Justin Seow, the CIO of Albizia Capital, and Wendy Yap, the founder and CEO of PT Nippon Indosari Corp., the largest bread producer in Indonesia

All three managers emphasized that their portfolio companies are performing well and achieving healthy profit growth but are trading at historically low valuations. Portfolio company earnings are forecast to grow 20% or greater in 2024. Their portfolios trade at just 8-9x forward earnings.

All three managers highlighted their ability to identify high growth companies before the rest of the market (“undiscovered gems”). We met with two such companies.

Cimory CEO Farell Sutantio presenting to the group

Meeting with the iFAST management team

Cisarua Mountain Dairy (Cimory) is the leading producer of premium dairy products and consumer foods in Indonesia. We met with CEO Farell Sutantio and CFO Bharat Joshi. They described how their focus on flavored yogurt and milk products and innovative marketing campaigns have super-charged revenue and profit growth. Revenue has grown by an average of 85% per year since 2020 while profits have grown even faster.

iFAST Corp is a digital banking and wealth management platform. We met with Wong Tin Niam, the GM of the Singapore business, and Lim Kian Thong, the CFO. iFAST recently signed a contract to provide the digital infrastructure for Hong Kong’s government pension program for residents. The contracted revenue and forecasted profits in 2024, the first full year, are large – HK$900 million in revenue and HK$250 million in profit. These amounts would, by themselves, increase iFAST’s revenue by 66% and more than double its profits. The annual increases included in the contract for 2025 and beyond are substantial.

The three managers highlighted several other companies in their portfolios whose strong operating performances are not reflected in their current stock prices. As iFAST has shown, stock prices can jump quickly once the market starts taking notice.

The main risks to SE Asian markets, according to the managers, are political – unstable governments or anti-business policies, and ongoing high US interest rates, which caused investors to pull money from SE Asian markets this year.

1. Key Catalyst for SE Asian Markets

SE Asia is experiencing a surge in FDI as global manufacturers seek to diversify outside of China. SE Asia replaced China as the largest recipient of FDI in 2022.

In 2022, SE Asia received four times as much FDI as India. Vietnam, by itself, received twice as much as India. The economies of SE Asia are relatively small compared to China and India, and the FDI is expected to substantially boost economic growth and income levels in these countries in the years ahead.

This scenario is similar to what occurred in Thailand in the mid 1980s. At the time, US trade restrictions caused Japan to massively increase FDI into Thailand. This surge in FDI supercharged Thai economic growth over the next decade.

The Thai stock market, which had been in a nine-year bear market from 1976-85, also surged, gaining over 1,000% from 1986-1993.

We believe that the current increase in FDI into SE Asia could act as a similar catalyst to SE Asian markets, especially in Vietnam, Indonesia, and The Philippines.

2. Advantages of The SE Asius Fund

We have been investing in SE Asia since 2013 with the launch of The Asius Fund. Over the years, we believe we have identified and invested with the leading investment managers in SE Asia. In May 2022, we set up the SE Asius Fund to offer investors dedicated exposure. The Asius Fund transferred its investments with the SE Asia managers to The SE Asius Fund.

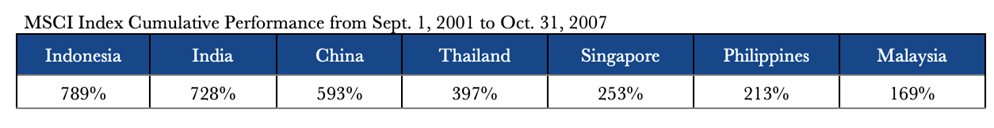

Our SE Asian managers have been able to generate a positive return for us since May 2013 even though SE Asian markets have declined significantly.

Our managers have been able to generate a positive return even though they predominately focus on mid and small cap companies. Mid and small caps have generally declined more than large caps in most SE Asian countries. The most extreme example is Indonesia, where mid and small caps have declined by over 70% since May 2013.

Our managers, though, perform best when markets are rising. In previous bull markets, they outperformed the index by an average of 3.5x.

In a world where developed country returns could be muted over the next several years, SE Asia offers substantial upside potential. The SE Asius Fund offers investors unique exposure to this region via local managers with extensive track records of investing in high growth companies that have performed strongly in rising markets.