New Cycle of Emerging Asian Market Outperformance

/We believe a possible cyclical transition occurred late last year that would provide a huge boost to our funds’ performances over the next several years. The relative performance between the US and Asia ex Japan markets is highly cyclical. There have been four cycles going back to 1988.

There are several indications that the most recent cycle of US market outperformance peaked in late 2022, and that we are now entering a period where Asia ex Japan markets outperform.

The emerging market index had its best relative performance over the US market over the last two months of 2022 in over a decade.

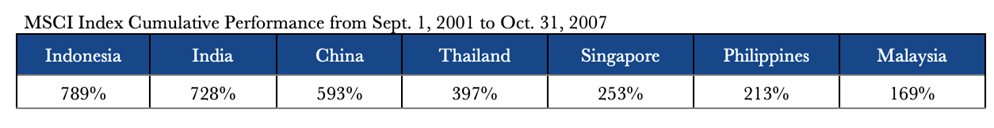

The implications of a new cycle are very positive for our funds. During the last cycle of Asia ex Japan outperformance from 2001-07, the markets we focus on had substantial multi-year gains.

Institutional investors have taken note of this transition. Jonathan Garner, Morgan Stanley’s Chief Asia and Emerging Market Strategist, stated recently that “we are confident that we are at the beginning of an emerging-market bull cycle.”

Global investors have reacted by withdrawing money from US equities and investing in emerging market equities.

This transition would turn the strong headwinds that our funds have faced over the past decade into equally strong tailwinds for the next several years.