The Case for Vietnam

/A trip this month to Ho Chi Minh City showed just how rapidly Vietnam is progressing. Chic restaurants and boutique hotels line the streets. Young people crowd into internet cafes and coffee shops. Foreigners, including South Korean industrialists, Swiss investment managers, French chefs and Australian backpackers clog the airports. Vietnam is attracting attention for good reason.

This is especially true from an investment perspective. Vietnam is one of the most promising frontier markets. Although it is poorer, and its equity markets are smaller and less developed than many of its Asian cousins, Vietnam is catching up rapidly. If it is able to do so, it will create substantial shareholder wealth in the decades ahead.

Vietnam has several attractive macro characteristics that are contributing to rapid economic growth.

Large, young and educated population. Vietnam has 94 million people, the third most populous ASEAN country after Indonesia and the Philippines. The average age is under 30, and only 35% live in cities. Even so, the literacy rate is above 95%. Population dynamics should provide a large boost to economic growth as more people enter the workforce, and move to cities and take on more productive jobs.

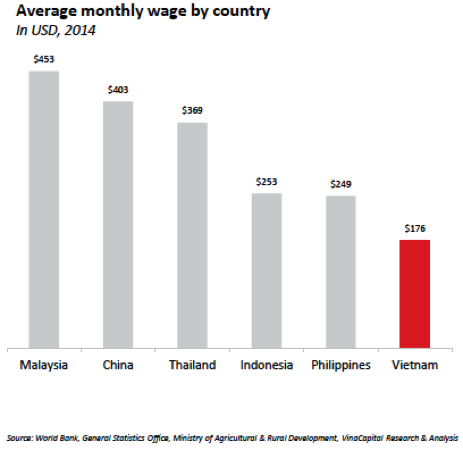

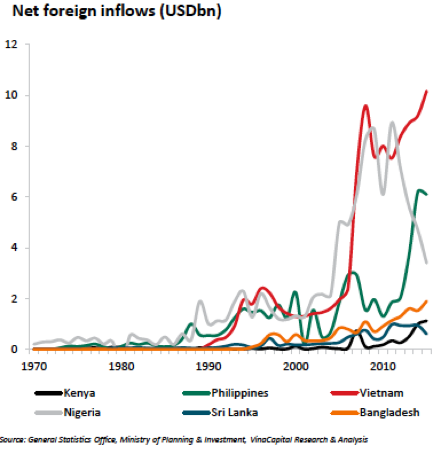

Competitive labor costs. The average Vietnamese worker earns less than $200 per month, less than half the cost of a Chinese worker and among the cheapest in Asia. As a result, Vietnam is experiencing a surge in foreign direct investment as manufacturers look for alternatives to China.

Rapid increase in per capita income and consumption. Vietnam is approaching the inflection point where income per person has shot up in other Asian countries (known as the S-curve for income growth). This cycle typically leads to a surge in consumer spending as people can increasingly afford aspirational items.

These factors are contributing to forecasted economic growth of 6.7% in 2016, among the highest in the world.

The Vietnam stock market, which was launched in 2000 with two stocks, now has almost 700 listed companies with total market capitalization of $61 billion.

The government recently passed several critical reforms that should provide a large boost to the stock market. These include:

- In September the government relaxed the 49% ownership limit for foreign investors to 100% for all companies except banks and a few strategically important sectors. Previously, several companies had been at the 49% limit for several years, which was a major restraint on foreign participation.

- The government is aggressively selling off state owned enterprises by listing them. There were 222 IPO’s of SOE’s in 2015 and another 174 companies have been identified for listing.

- Increasing the level of corporate disclosures, which is one of the last hurdles necessary for MSCI to promote Vietnam from a “frontier” market to an “emerging” market. Attaining emerging market status would open up its stock markets to a much larger pool of investors.

Vietnam currently trades at a significant valuation discount to other Asian markets even though its companies generate a much higher return on equity and pay out one of the highest dividends. It is attractive on many fronts.

We believe that the best way to capitalize on the growth of Vietnam’s equity markets is to do so through locally based managers with deep knowledge of local markets and companies. We specifically seek out managers that excel at identifying rapidly growing companies that are often overlooked or misunderstood by the market.

Surprisingly for a frontier market, Vietnam has several fund management firms with long track records and large teams of analysts. We look forward to adding one or more Vietnam managers to our portfolio. Although Vietnam is still in the early stages of development, we believe it is poised for take-off.

Chinus Asset Management (CHAM), a U.S. West Coast-based asset management firm, provides investors exposure to the alpha-generating growth in China, India, South Korea and Southeast Asia, by utilizing an active investment strategy and local managers in each region.

© 2016, Chinus Asset Management, LLC.